Anxiety: Looking at the Psychology of Finance Through a Psychoanalytic Lens

Fourth in a Series

Anxiety is ubiquitous. It serves an essential function—alerting us to danger, to the need to reassess the environment, to act.

It is a both physical and emotional. Anxiety is a state of biological arousal that is actively communicating something to you: “Wake up, pay attention, get out of danger”.

As with all other psychological phenomena I describe in this series, you can’t avoid anxiety—to do so would be akin to being a person who doesn’t experience pain, and is therefore very vulnerable to injury. But by understanding it, knowing your personal anxiety-related idiosyncrasies, and learning to listen to and manage anxiety you can both use it and also avoid falling prey to mistakes anxiety can contribute to.

Anxiety disorders develop when anxiety gets way out of hand, taking on a life of its own. There’s often a genetic contribution to these mental health conditions that include panic disorder and OCD. But in this post, I’m talking about “normal” anxiety that rises in everyone and anyone under certain conditions—and it can be pretty intense and still normal.

Intense anxiety bordering on panic is incredibly uncomfortable. Most of us will do anything we can to avoid it or stop it. There’s nothing inherently wrong with this strategy, unless the avoidance-thing-you-do becomes a habit or leads you to ignore important incoming data.

In moderate doses anxiety is alerting. In large doses, it is disorganizing. So, in addition to recognizing anxiety and it’s sources, you need to learn to assess your level of anxiety and act accordingly.

Although we talk about different types of anxiety, the subjective experience is a final common pathway for multiple triggers or sources.

In this post, I’m going to describe four kinds of anxiety that might be under your radar. This is not meant to be an exhaustive list. But these are some variations of anxiety that I think you should know about:

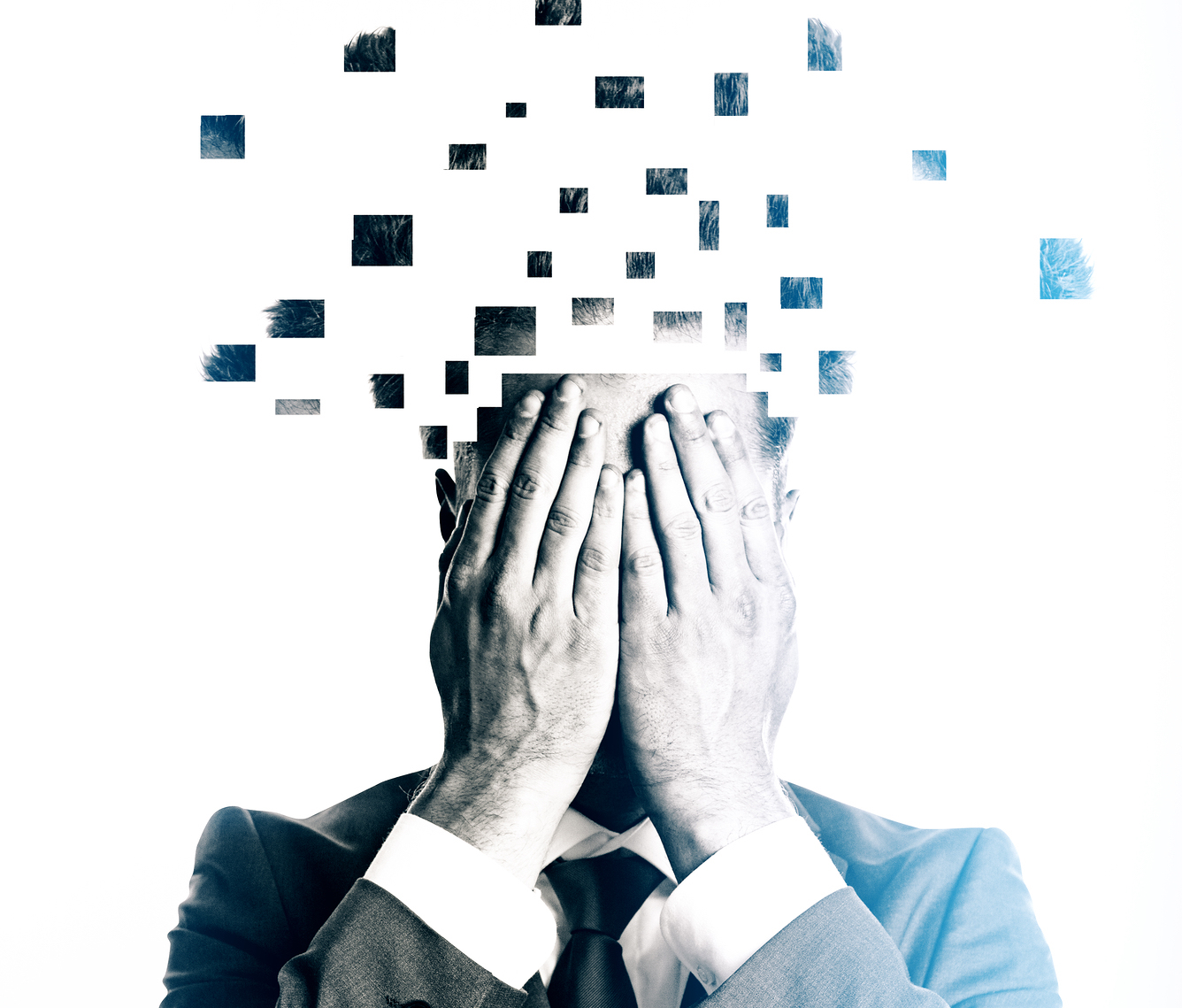

Annihilation anxiety-Psychoanalysts consider this the most primitive and disorganizing kind of anxiety. “Annihilation” refers to psychological, not physical undoing. Under sway of this type of anxiety, you feel that you can’t get ahold of yourself, or you’re falling apart, or you’re losing your grip. Things can feel unreal and fractured. The circumstances where this kind of anxiety might occur include emotional overload or an extreme amount of change or disruption, dislocation, or loss of customary supports. Even positive events can be overwhelming in this way.

Annihilation anxiety tends to be non-specific, so even with skillful introspection you’re not going to come up with a distinct cause or solvable problems. Consider this report from John D. Rockefeller, Sr., looking back on his early years building Standard Oil:

“For years on end I never had a solid night’s sleep, worrying about how it was to come out…I tossed about in bed night after night worrying over the outcome…All the fortune that I have made has not served to compensate for the anxiety of that period”. (quoted in Titan, Ron Chernow, p. 122).

A few things are striking about the Rockefeller quote. Notice that his anxiety is diffuse. He’s not worrying about this contract or that refinery, but, vaguely, “how it was to come out”. And the intensity and pain of his anxiety is clear from the fact that it is still so vivid decades later, as well as in his statement that all his subsequent riches don’t make up for it.

Annihilation anxiety’s primary value is to tell you that you are overwhelmed. It doesn’t signal specific problems to solve.

Narcissistic anxiety—I’ve never met a single person who doesn’t hate feeling humiliated, exposed or shamed. Anxiety comes in to this picture in two ways. First, each of us has a different threshold of tolerance for these experiences. If you’re a person with a thin skin who is easily humiliated or often feels exposed, you’re likely to have chronic anxiety worrying that this very uncomfortable experience is about to occur. This anticipatory anxiety can skew your decision making. The second entry point for narcissistic anxiety comes after you are embarrassed/humiliated/exposed by something dumb you did. If you’re overly aware of or sensitive to what people might think, you’re going to lose focus worrying about how they are viewing you rather than collecting yourself and getting back to work.

Traumatic anxiety- Here, I’m talking about real but not overwhelming traumatic experiences. Trauma states occur when events override your customary coping mechanisms. We are vulnerable to traumatic states when events are unprecedented, unpredicted, unfamiliar, sudden. During the height of Hurricane Harvey, the National Weather Service tweeted: “This event is unprecedented & all impacts are unknown & beyond anything experienced”. To me, the NWS description of this level of uncertainty meant the forecasters there were subject to traumatic levels of anxiety, not to mention 1st responders and emergency managers.

Idiosyncratic Anxiety –anxiety reactions that are unique to you. Some things are going to make you anxious that don’t make other people anxious. I’m not talking about something clear-cut, like you are afraid of flying and others are not, but a subtler pattern of reactivity that stems from your individual temperament and psychological history. Let’s say everyone acknowledges that the market is over-valued; prices are too high but they are still going up. Your colleagues are on the boat still making money on the rising tide. You’ve done well too, but have a much stronger urge than your peers to get out of your long bets before your stocks’ value has peaked. The excitement seems crazy to you and makes you very, very nervous. The over-excited market correctly makes you anxious, sending a useful signal that this can’t last. But your anxiety response may be a shade too strong if you especially can’t stand this kind of irrationality and you’re apt to pull the plug too soon. Remember, anxiety is always a useful signal. But you need to make sure that you don’t over-react or under-react to it.

What you can do

As with every psychology factor that can effect investment decisions, information and self-knowledge is the most important remedy. Understand and accept that anxiety is normal and inevitable.

See my blog post on self-reflection for some insights on building insight and self-awareness.

If your anxiety has the characteristics of annihilation anxiety, the best immediate antidote is to do something concrete and manageable with a definable endpoint. Update your charts or your trading journal. Organize your desk or your sticky notes. Cling to your routines and habits. Don’t make decisions until you can think more clearly. Get something to eat, drink a bottle of water, go to the gym.

When your anxiety is related to humiliation or exposure, try a conversation with yourself. Acknowledge that you hate the feeling of humiliation because, well, it’s just plain awful—but remind yourself you’ll survive. Then look at your decisions carefully and see if any are being swayed by a desire to avoid being humiliated. The point isn’t to get rid of the feeling, because you can’t, at least not in the short run. The goal is to avoid compounding the problem by letting it lead you to bad financial decisions. In the end, it’s better to make a good investment decision and risk being embarrassed than to make a bad one in a probably futile effort to avoid humiliation.

Get to know yourself better so you are intimately acquainted with your idiosyncratic sources of anxiety. Look carefully at how these patterns of emotional reactivity might be systematically tilting your investment decisions. Add rules to your trading program to prevent yourself from making systematic anxiety-based errors. Read more on the psychology of trading rules and why you will inevitably break them in this related post.

###

copyright September 2017

Invantage Advising

Other posts in this series:

For Professional Investors: Why You Won’t Follow Your Own Rules and What to Do About It

Why Professional Investors Need to Understand the Concept of Disavowal

Why Professional Investors Need to Understand the Concept of Regression